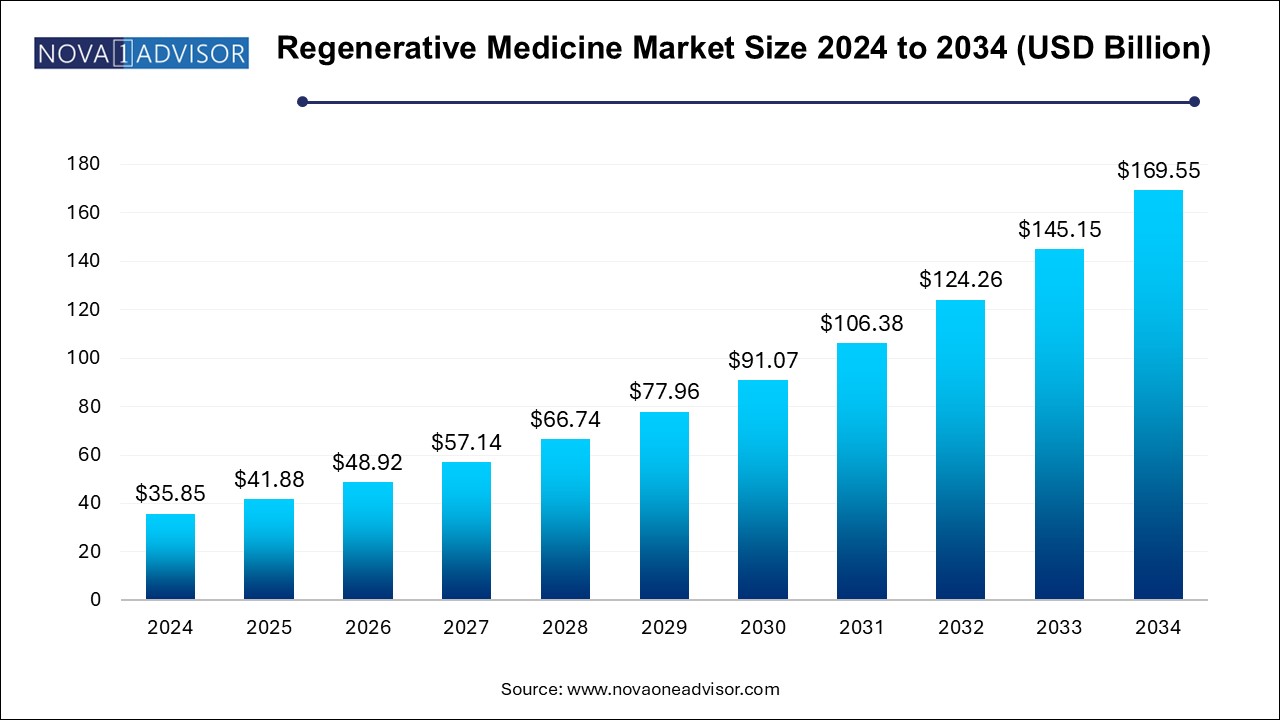

The regenerative medicine market size was exhibited at USD 35.85 billion in 2024 and is projected to hit around USD 169.55 billion by 2034, growing at a CAGR of 16.81% during the forecast period 2025 to 2034. The market is growing due to the rising chronic diseases, increasing demand for organ and tissue replacements, and advancements in stem cell and gene therapy technologies. Additionally, supportive government policies and growing investments are accelerating research and commercialization.

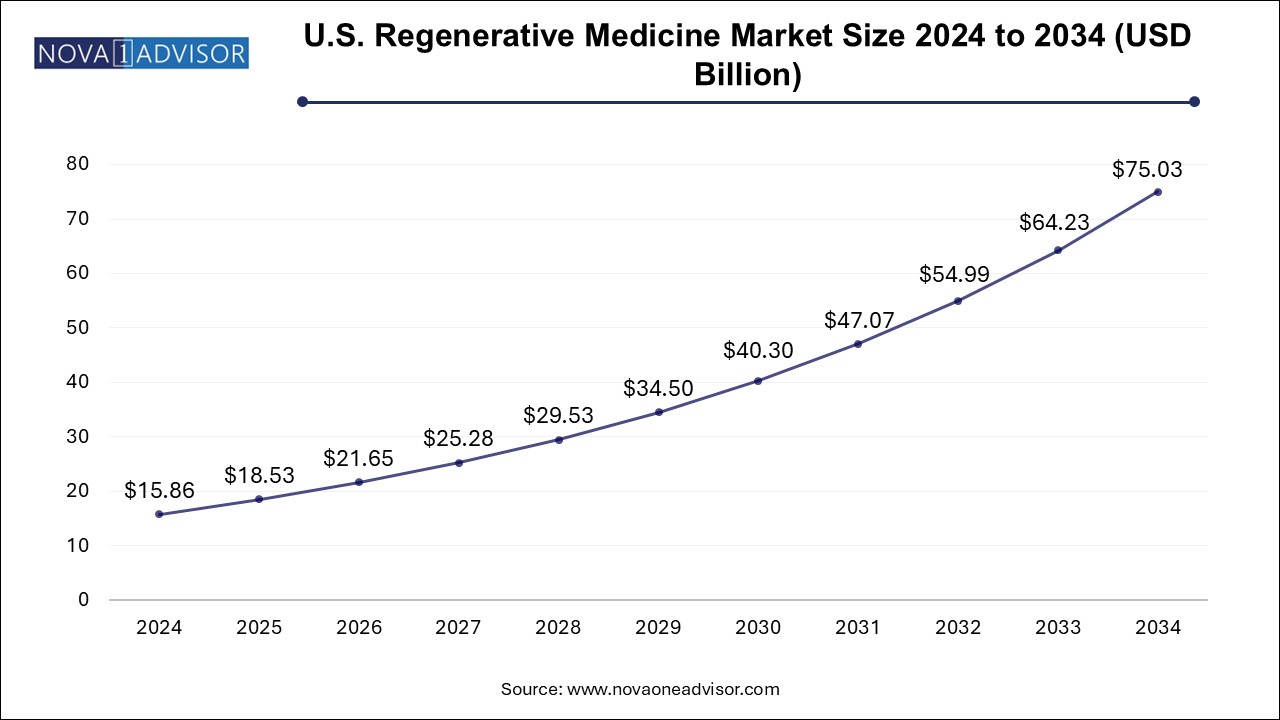

The U.S. regenerative medicine market size is evaluated at USD 15.86 billion in 2024 and is projected to be worth around USD 75.03 billion by 2034, growing at a CAGR of 15.17% from 2025 to 2034.

How is North America Contributing to the Expansion of the Regenerative Medicine Market?

In 2024, North America dominated the regenerative medicine market due to its advanced healthcare infrastructure, substantial investments in research and development, and a favorable regulatory environment. The region's leadership is bolstered by a high prevalence of chronic diseases, such as cancer and cardiovascular conditions, driving demand for innovative therapies. Additionally, the presence of leading biotech firms, academic institutions, and an increasing number of clinical trials contribute to its prominent position in advancing regenerative treatments.

How is Asia-Pacific Accelerating the Regenerative Medicine Market?

The Asia-Pacific region is expected to experience the highest growth in the regenerative medicine market during the forecast period, driven by several key factors. These include increasing healthcare investments, a large and aging population, and a rising prevalence of chronic diseases such as cardiovascular and neurodegenerative disorders. Countries like Japan, China, and South Korea are leading in stem cell research and regenerative therapies, supported by favorable government policies and funding. Additionally, advancements in biotechnology and growing medical tourism further contribute to the region's rapid market expansion.

Regenerative medicine is a multidisciplinary field that aims to repair, replace, or regenerate human cells, tissues, or organs to restore normal function, using methods such as stem cell therapy, tissue engineering, and gene therapy. Innovation is propelling the regenerative medicine market through breakthroughs in stem cell therapies, gene editing, and 3D bioprinting, enabling precise and personalized treatments. The integration of artificial intelligence is streaming drug discovery and clinical trials, enhancing efficiency and patient outcomes. These technological advancements, combined with a supportive regulatory framework and increased investment are accelerating the development and commercialization of regenerative therapies, addressing unmet medical needs, and expanding the market’s growth potential.

What are the leading trends shaping the Regenerative Medicine Market in 2024?

Artificial intelligence is revolutionizing regenerative medicine by accelerating drug discovery, optimizing cell and gene therapy development, and enabling personalized treatment strategies. Machine learning algorithms analyze complex biological data to predict patient responses and identify optimal therapeutic approaches, enhancing treatment efficacy and safety. AI also streamlines clinical trials and automates tissue engineering processes, reducing time and costs associated with bringing regenerative therapies to market.

| Report Coverage | Details |

| Market Size in 2025 | USD 41.88 Billion |

| Market Size by 2034 | USD 169.55 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 16.81% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Therapeutic Category, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | AstraZeneca plc; F. Hoffmann-La Roche Ltd.; Integra Lifesciences Corp.; Astellas Pharma, Inc.; Cook Biotech, Inc.; Bayer AG; Pfizer, Inc.; Merck KGaA; Abbott; Vericel Corp.; Novartis AG; GlaxoSmithKline (GSK). |

Driver

Increasing Number of Clinical Trials

The growing number of clinical trials is driving the regenerative medicine market by validating the safety and effectiveness of innovative therapies such as stem cell treatment and gene editing. These trials help build regulatory confidence, attract investor funding, and accelerate product approvals. As more therapies advance through clinical stages, the likelihood of commercialization increases, expanding treatment options for patients and boosting market growth. This surge in trials reflects rising interest and confidence in regenerative solutions.

Complex Manufacturing of Regenerative Medicine

The complex manufacturing process of regenerative medicine is a major restraint due to the need for highly specialized equipment, strict quality controls, and skilled personnel. Producing therapies like stem cell treatment or tissue-engineered products requires precise conditions and is time-consuming and costly. Additionally, scaling up production while maintaining consistency and meeting regulatory standards poses significant challenges. These factors limit accessibility, slow down commercialization, and increase the overall cost of bringing regenerative therapies to market.

Expanding Application of Regenerative Medicines

The expanding application of regenerative medicine presents a major opportunity as its use extends beyond traditional areas like orthopedics and oncology to include neurology, cardiology, and autoimmune disorders. Advances in stem cell research, tissue engineering, and gene therapy are opening doors to treat a broader range of chronic and rare diseases. This diversification not only increases the patient pool but also drives investment and innovation, boosting long-term growth potential in the regenerative medicine market.

Why Did the Therapeutics Segment Dominate in the Regenerative Medicine Market 2024 ?

The therapeutic segment holds the biggest shares in the market due to the increasing prevalence of chronic and age-related diseases such as cancer, diabetes, and neurological disorders. This surge in health conditions has intensified the demand for innovative treatments, prompting substantial investments in research and development. Advancements in stem cell therapies and gene editing have further propelled the growth of this segment, as they offer a promising solution to previously untreatable conditions. Consequently, the therapeutic segment continues to drive significant revenue within the regenerative medicine market.

Primarily, these banks streamline research by efficiently collecting, storing, and curating human tissues and cells thereby reducing the time, effort, and cost for researchers. Moreover, the increasing adoption of cell-based and tissue engineering approaches in medical applications has expanded the role of these banks beyond research, catering to clinical and therapeutic needs. The rise in clinical trials for stem cell and tissue-based therapies further amplifies the demand for banking services, positioning significant growth in the coming years.

What Made the Oncology Suites the Dominant Segment in 2024?

The oncology segment has dominated the regenerative medicine market largely due to the growing global incidence of cancer and largely due to the growing global incidence of cancer and the demand for more effective, targeted therapies. Regenerative approaches, such as CAR-T cell therapy and gene-based treatments, offer personalized solutions that can attack cancer cells while minimizing damage to healthy tissue. These therapies have shown promising results in treating hematologic and solid tumors. Additionally, increased research funding supportive regulatory pathways, and rising investment from biotech firms have accelerated innovation in the field. As a result, oncology remains a major focus area, driving the overall growth and advancement of regenerative medicine.

The cardiovascular segment is poised for notable growth in the regenerative medicine market due to the rising prevalence of heart diseases and advancements in regenerative therapies. Innovations such as stem cell therapy, tissue engineering, and gene editing are being developed to repair and regenerate damaged heart tissues, offering alternatives to traditional treatments. These therapies aim to restore cardiac function and reduce the need for transplants. The increasing adoption of these advanced treatments underscores the significant growth potential in the coming years.

In February 2024, Iovance Biotherapeutics received FDA approval for its TIL therapy, AMTAGVI (lifileucel), a personalized cell-based immunotherapy. It is intended for adults with unresectable or metastatic melanoma who have previously been treated with a PD-1 inhibitor and, if BRAF V600 positive, a BRAF inhibitor with or without a MEK inhibitor. This marks a major advancement in autologous cell therapy for hard-to-treat melanoma cases.

In September 2023, Dr. Samuel Lynch, a seasoned biotech entrepreneur, founded Lynch Regenerative Medicine, Inc. (LRM), a company focused on developing advanced biotherapeutic skincare solutions. LRM aims to address gaps in the aesthetic and advanced wound care markets by offering innovative treatments for unmet clinical needs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Regenerative Medicine Market

By Product

By Therapeutic Category

By Regional